Meet Your Sustainability Targets & Profit From a Growing Asset Class

Acquire, manage, and expand the market for digital carbon. The fund will be a mix of Digital Assets (80%) and Carbon Streaming projects (20%) to bring more carbon offsets to the blockchain. This fund allows investors direct access to carbon backed tokens and is meant to profit and help shape this growing asset class.

GO IN-DEPTH: PORTFOLIO HIGHLIGHTS | EXPECTED RETURNS

Investing In Carbon Offsets More Efficiently

Highlights

The voluntary carbon market grew over 100% to $1B in 2021 from $473M in 2020.

Digital Tokens and Assets tied to Voluntary Carbon Markets are expected to scale to 15x their current size by 2030, according to McKinsey & Co.

New Asset Markets developing within carbon markets (Blue Carbon, Soil Carbon, Agroforestry, etc.) and other sustainable assets will be brought to a global audience through Crypto & DeFi.

Portfolio Management Techniques (Yield Farming, Staking Income, etc.) to enhance the underlying growth assumptions of the carbon credits to produce >10% returns in a space that has little to no correlation to other asset classes.

Carbon Streaming focused on cookstove projects in Uganda generating a fixed stream of offsets. Working with UpEnergy, a 10-year-old leader in the space.

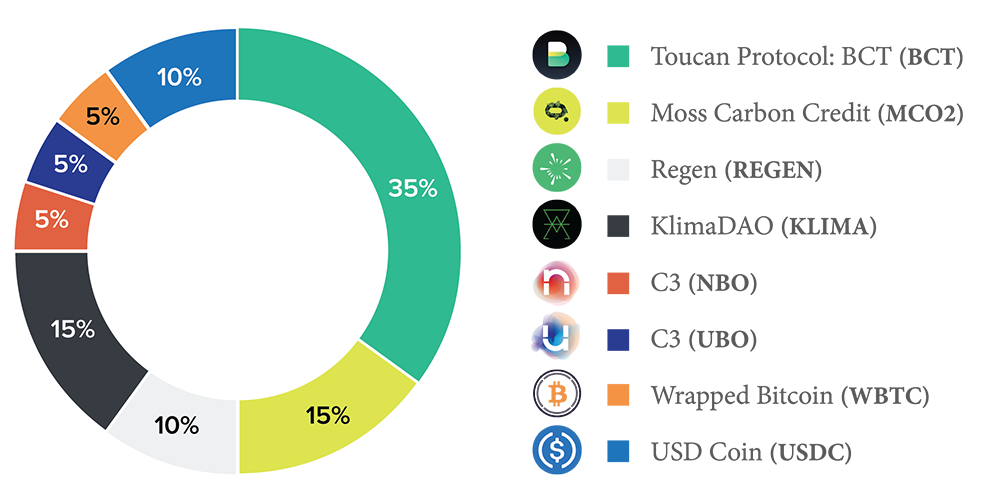

Model Portfolio

Carbon Strategies & Allocations

Company Partners

Confluence is an elite team of financial professionals, software developers and successful entrepreneurs dedicated to accelerating the adoption of ESG and DeFi by making it accessible to organizations both large and small.